I was chatting with some friends recently when one of them asked, “How exactly is public school funding set up?” Given my background in education, I assumed most people knew the answer—but then I realized it’s not as widely understood as I thought.

This post is a great opportunity to break it down.

The Basics: Where Does Public School Funding Come From?

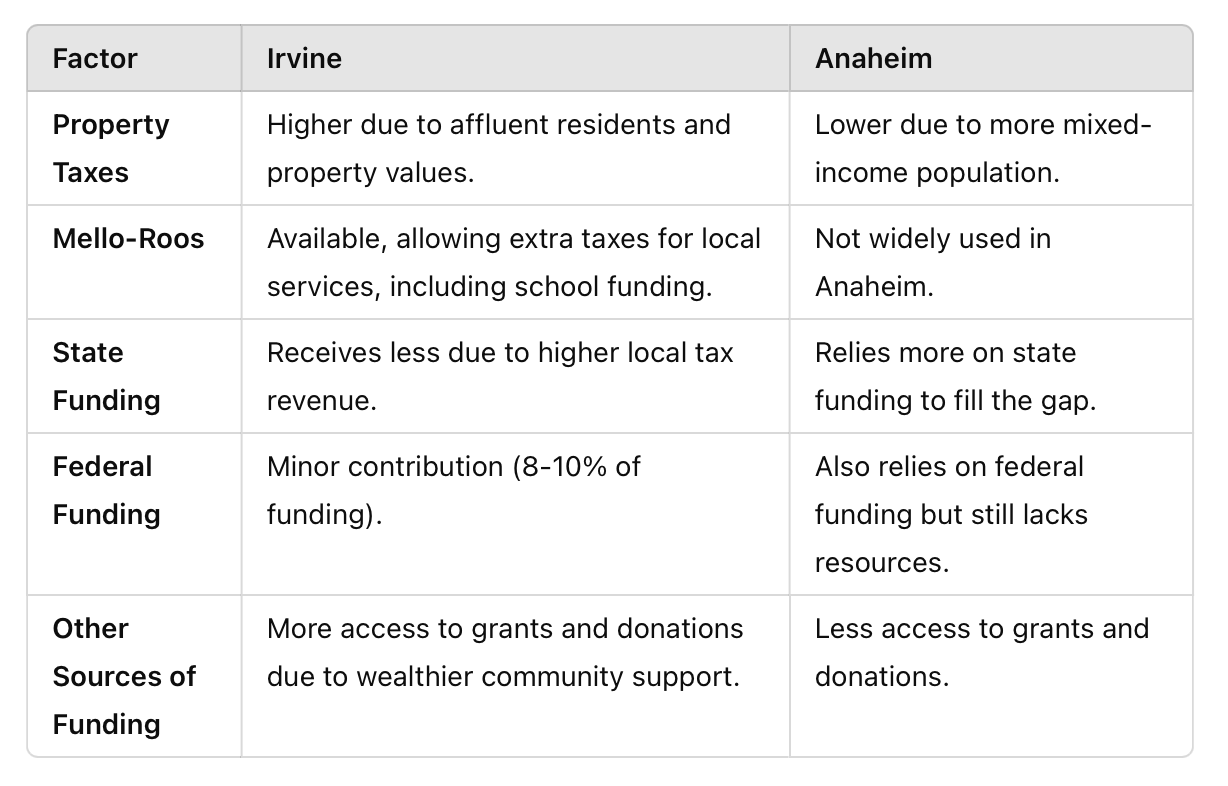

In the U.S., public schools receive funding from a mix of local, state, and federal sources. While this system is meant to create balanced educational opportunities, the reality is that how funds are distributed often leads to major disparities between school districts.

The Orange County, California Example:

Pop culture often portrays Orange County—through shows like The O.C. and Laguna Beach—as a hub of wealth and privilege. But in reality, the county is far more economically diverse.

Cities like Irvine, Laguna Beach, and San Juan Capistrano have significantly higher property values.

Cities like Santa Ana, Anaheim, Lake Forest, and parts of Mission Viejo have lower property values and more mixed-income populations.

For example, in 2022, Laguna Beach had a median household income of $141,000, while Santa Ana’s was $80,000—a figure that doesn’t account for the many households where multiple families live together. These differences have a direct impact on school funding and the resources available to students.

Local Funding: Property Taxes Drive School Budgets

The biggest source of school funding comes from local property taxes—meaning the wealth of a community directly affects the resources available to its schools.

Irvine: Higher property values generate more revenue for schools. The city also benefits from Mello-Roos districts, where residents pay extra taxes specifically for local services like education.

Anaheim: A more mixed-income population means lower property tax revenue, leading to less funding for schools.

State and Federal Funding: Can They Close the Gap?

State Funding: California uses a formula to redistribute money to lower-income districts, but it doesn’t fully close the funding gap.

Federal Funding: The federal government provides around 8-10% of school funding, mostly for special programs like support for low-income students or special education. However, it’s not enough to balance out disparities caused by local property taxes.

Other Sources: Schools also rely on grants, donations, and fundraisers, but these vary widely, deepening the gap between wealthy and lower-income districts.

Proposition 13: A Key Factor in School Funding Disparities

California’s Proposition 13, passed in 1978, limits how much property taxes can increase each year. While this stabilizes taxes for homeowners, it also means that:

Wealthier areas like Irvine continue to benefit from high property tax revenues.

Lower-income areas like Anaheim struggle with limited school funding.

This policy has had long-term effects on funding disparities, which we can explore further in a future post.

Why This Matters

The contrast between Irvine and Anaheim clearly shows how local wealth impacts school funding. Wealthier areas generate more local revenue, giving their schools better resources, while lower-income areas rely more on state and federal funding that doesn’t fully make up for the difference.

Understanding these disparities helps us advocate for more equitable education policies—and informs how we vote in local elections.

Take Action

By understanding how public schools are funded, we can make more informed choices at the ballot box. Let’s work toward ensuring all students—regardless of where they live—have access to the resources they need to succeed.